Kikuo Hayakawa, NOST Tokyo

Origineel gepubliceerd op de site van Agentschap NL.

Samenvatting

De Japanse staalindustrie loopt voorop in de ontwikkeling van hoogwaardig staal en energiezuinige productietechnologie. Een belangrijke afzetmarkt voor de staalindustrie is de scheepsbouw, waarvan ongeveer 85% van de markt in handen is van Zuid-Korea, Japan en China. De Japanse staalindustrie is bekend om de hoge kwaliteit producten voor de scheepsbouw. Het vooruitstrevende Japanse R&D-systeem voor de scheepsbouw heeft de eigenschappen van staal verbeterd, de veiligheid van het schip verhoogd en de kosten voor productie en onderhoud verlaagd. De Japanse overheid is onlangs een project met de staalproducenten en universiteiten gestart voor de reductie van CO2-emissies in de staalindustrie. Voor de toekomst zet de sector in op nieuwe methoden om de levensduur van schepen te voorspellen en het veiligheidsniveau te evalueren. Verdere ontwikkelingen in de staalindustrie kunnen leiden tot nieuwe soorten schepen: grotere schepen, schepen die in bevroren waterwegen kunnen varen, tankers voor vloeibaar CO2 en dergelijke.

Abstract

Japanese steel industry has been leading the world in terms of quality improvement and its energy-saving production technologies. Shipbuilding is one of the major market for the steel industry, and roughly 85% of ships are built in South Korea, Japan and China. Japanese major steel producers are highly regarded for its quality steel plates for vessels. The Japan’s R&D on steel for shipbuilding has improved the steel performance and ship safety, and has reduced the shipbuilding and maintenance cost. Recently Japanese government launched a project joined by steel producers and universities to reduce CO2 emissions in the steelmaking plant. Future developments on steelmaking in Japan focus on technology to estimate the lifetime of ships and assess its safety level. Further improvement of steel can lead to new types of ships in the future, such as larger ship, ice going ship, and Liquefied CO2 tankers etc.

Steel history in Japan

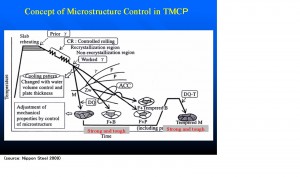

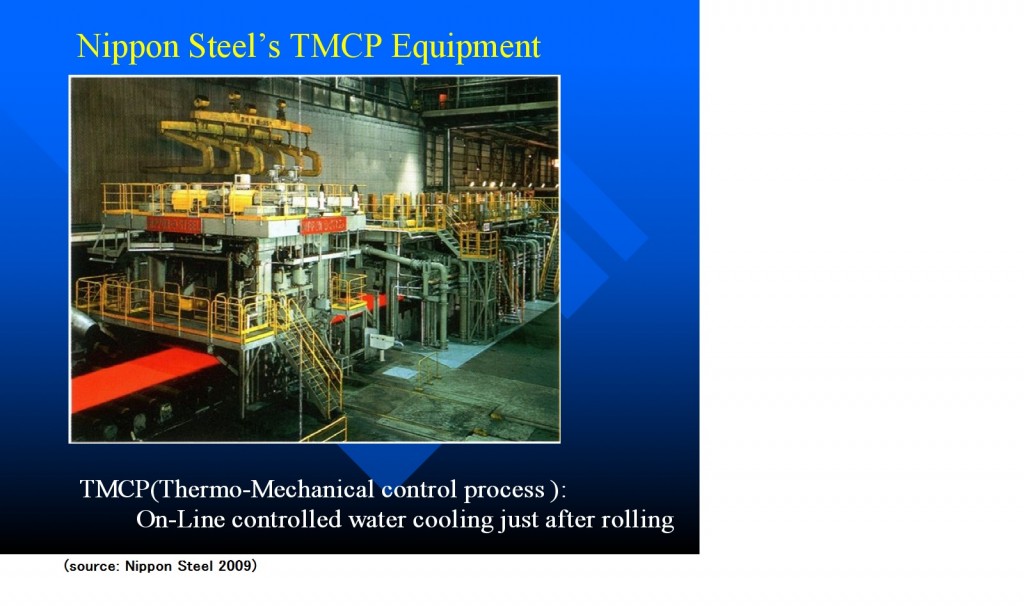

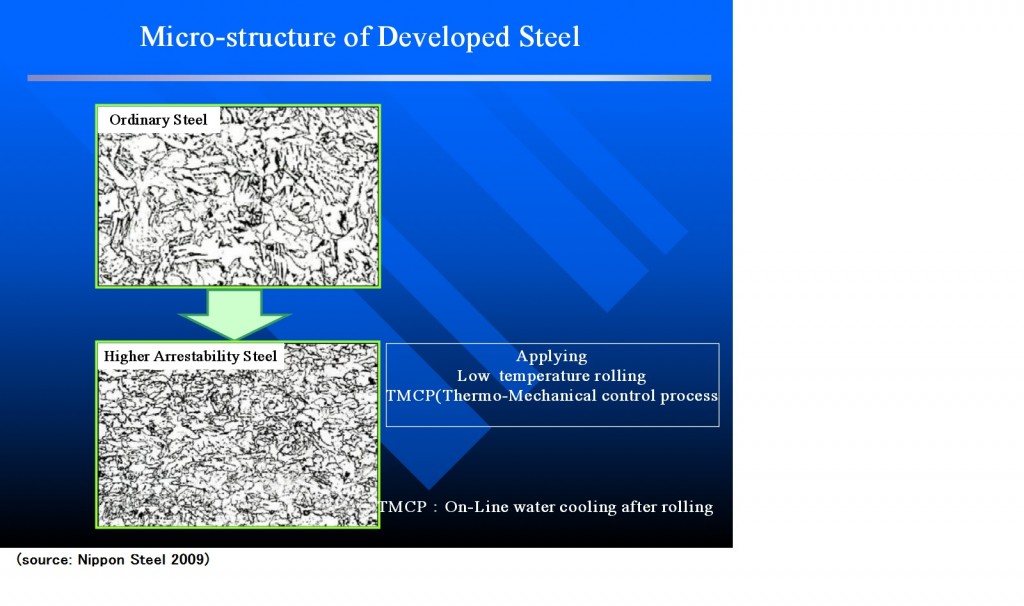

The world-famous Japanese sword “nihonto” or “samurai sword” has been manufactured in Japan since the 14th century. The authentic Japanese sword is made from two varieties of steel. Hard high carbon steel is used for the outer edge and malleable low carbon steel is used for the core. ,Water was originally used to cool down the steel quickly in order to make it harder. The present Japanese sword craftsmen still use this procedure. In the 1950’s the Japanese steel industry began to import mass production technologies from the German steel producer Mannesmann in order to live up to the huge domestic demand for steel as a consequence of Japan’s high economic growth. In the 1980’s Japanese major steel producer JFE Steel (the former NKK) applied and developed the world-first inline water-cooling mass production system for steel manufacturing. This was called the Thermo-Mechanical Control Process (TMCP). Other major Japanese steel producers followed this lead. Although European universities were ahead in basic research on TMCP at that time, the Japanese steel industry was the first to commercialize the process. At the moment, TMCP-equipment is widely used throughout Europe, USA and East Asia. Still more than half of all TMCP-equipment in the world is used in Japan. With TMCP the microstructure of steel can be controlled in mass production thanks to knowledge driven custom-made process settings that are strictly confidential. (Figure 1&2).

Figure 1. Example of TMCP Equipment (Nippon Steel)

Figure 2. Concept of Microstructure Control in TMCP

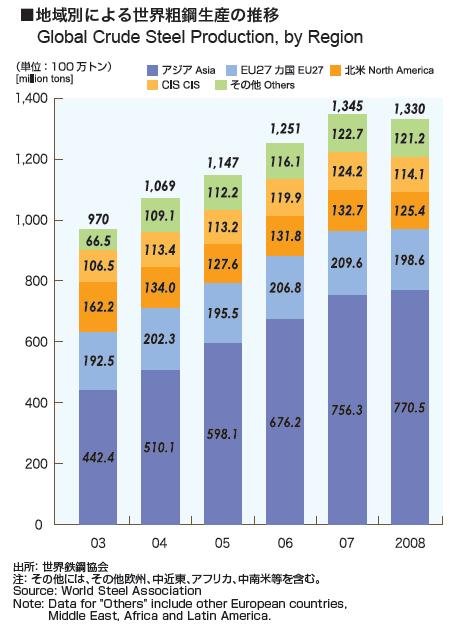

Crude steel /plate steel production

With regard to crude steel production, the share of Asia, especially China, in total production increases rapidly year by year. Japan still is the second largest producer of crude steel in the world (Figure 3).

Figure 3. Global Crude Steel Production by Region

Figure 4. Plate Production of Nippon Steel

The Japanese steel industry now faces challenges such as an expanding crude steel production in other countries. Also, it has to respond to their clients shift to overseas production. For instance it is estimated that 21 million tons of steel have been used in 2008 for shipbuilding throughout the world. Roughly 85% of ships in the world are built in Korea (40%), Japan (30%) and China (15%). The share of both China and Korea is expanding with new mass production facilities, while the share of Japan decreases. Japanese major steel producers are still highly valued for the high quality of their heavy steel plates for shipbuilding. TMCP-equipment is still being improved and R&D on steel still results in new valuable knowledge. Japan’s top-4 major steel producers, Nippon Steel, JFE Steel, Sumitomo Metal and Kobe Steel slightly increase their steel production for shipbuilding, thanks to increased shipbuilding demand in the world. Nippon Steel even almost doubled its production of plate steel for shipbuilding from 1.1 million tons in 2002 to 2.1 million tons in 2007 (Figure 4). Looking at other Asian countries, Korea’s top steel producer POSCO has rapidly increased steel plate production for shipbuilding and has been rapidly improving quality, almost equalling the quality of Japanese steel. The Chinese government promotes improvement of the domestic steel quality by technology transfer from foreign (or Japanese) steel producers.

High-tech steel for shipbuilding

While light plate steel is used in the car manufacturing industry, heavy steel plates are used for shipbuilding. steel producers are required to supply strong, tough and weldable steel. Year by year the size of container ships increases to reduce total shipping costs. In order to adapt to the demand for larger ships, thinner high-tensile strength steel is being developed. To improve steel performance for shipbuilding, Japan’s major steel manufacturers invest in research and development in co-operation with Japanese major universities(basic research) and ship-owners/shipyards (application). Each Japanese steel manufacturer has privately invested in the development of high tech steel varieties without any government R&D funding.

Nippon Steel (NSC) is one of top-5 steel producers in the world and the largest steel producer in Japan. Also NSC is one of most active parties in the development of new performance steel. As one of recent steel developments, NSC has developed the higher arrestability steel for large container ships, in co-development with Japanese shipbuilding company Mitsubishi Heavy Industry. The higher arrestability steel has been made using TMC- equipment with an in-line cooling water process. The microstructure of higher arrestability steel is more precious than ordinary steel (Figure 5). This steel variety reduces the risk of shipwreck as a consequence of brittleness. Already some forty large container ships are under construction using this steel variety.

Figure 5. Micro-structure of developed steel (higher arrestability steel)

To reduce maintenance costs, NSC has developed anti-corrosive steel for oil tankers (NSGP-1) and an anti-fatigue method for welded joints (UIT). NSGP-1(Nippon Steel’s Green Project- 1) is the world-first technology of applying anti-corrosive steel which does not need coating. Therefore NSGP-1 enables it to reduce maintenance costs. NSGP-1 has been co-developed with the Japanese shipbuilder Nippon Yusen KK. NSGP-1 will be possibly included in the new IMO regulations in March 2010. UIT (Ultrasonic Impact Treatment) is a method to improve the fatigue strength of welded joints. An ultrasonic wave (27-34kHz) tool by the US company Applied Ultrasonic Corp., is applied for the building industry. NSC is the first to apply UIT for shipbuilding and maintenance. Both technologies enable a longer lifecycle. To improve the ship’s safety, NSC has developed the application of high deformability steel for the bulbous bow of a ship (NS-Ship-Safety235) in order to reduce collision damage in case of a collision. NS-Ship-Safety235 has been co-developed with Imabari Shipbuilding Co.

Governmental research project to reduce CO2-emissions

As Japanese steel producers depend entirely on import of iron ore and coal, they have invested great efforts in saving energy. They reach the technological limits now. Therefore, since 2008 the Japanese steel industry has started working on a governmental project called COURSE50 (CO2 Ultimate Reduction in Steelmaking Process by Innovative Technology for Cool Earth 50), funded by Japanese governmental R&D-funding organization NEDO (New Energy and Industrial Technology Development Organization). COURSE50 aims to achieve a significant reduction in CO2 emissions from steelmaking processes. The project is joined by six major Japanese steel producers, six Japanese universities and research institute RITE (Research Institute of Innovative Technology for the Earth) etc.

The first half project of COURSE50 (phase I) plans to spend total 25 billion yen (189 million euro) for 8 years until 2016. NEDO aims to drastically reduce CO2 emissions in the steelmaking process by tackling the following research and development challenges:

Technology to reduce C2 emission from blast furnaces

– To develop reaction control technology to reduce iron ore by using hydrogen or other substances, thereby reducing coke consumption

– To develop coke oven gas (COG) reforming technology that increases the amount of hydrogen produced

– To develop technology to manufacture high-strength and high-reactivity coke for hydrogen-reduction blast furnaces

Technology to separate and recover CO2

-To develop a high-efficiency CO2 absorption method and to evaluate its performance in a pilot plant

-To develop technology that effectively utilizes unused waste heat in steelmaking plants for CO2 separation and recovery

Figure 6. Overview of development of environmental technology for steelmaking process (Japanese governmental project)

Future development

For Japanese steel producers, future development is considered the development of the technology to estimate ship’s lifetime and assess its safety level. The average of ship lifetime is thought to be 25 years. If the technology will be improved, it will be helpful for ship owners to know their ship’s safety level and to know what maintenance is needed. And will possibly yield the longer lifetime of ship than the average. Further improvement of steel can lead to new types of ships in the future, such as larger ship, ice going ship, and Liquefied CO2 tanker etc.

Sources

1. The Steel Industry of Japan 2009 (Japan Iron and Steel Federation)

2. Executive Summary Ch.3, Science and Technology Trends – Quarterly Review 2009. 10, NISTEP (October 2009)

3. Presentation “Latest topics of Steel plates for ship building” (Nippon Steel Corp.)

4. JFE Steel/Mr. Tsuyama, Key Technology and Movement of Steel Plate Production under Industrial Globalization (Japan Iron and Steel Federation)

5. NEDO Projects – Energy and Environmental Technologies 2008-2009

Links

Japan Iron and Steel Federation – http://www.jisf.or.jp/en/index.html

Nippon Steel – http://www.nsc.co.jp/en/index.html

JFE Steel – http://www.jfe-steel.co.jp/en/index.html

Sumitomo Metal – http://www.sumitomometals.co.jp/e/index.html

Kobe Steel – http://www.kobelco.co.jp/english/index.html

NEDO – http://www.nedo.go.jp/english/index.html